All about cigars

How to invest in premium cigars

Find out how to invest wisely in premium cigars and maximize your return on investment with our expert advice...

In the world of investment, few assets combine passion and profitability as admirably as cigars. Whether you're an amateur or a seasoned enthusiast, cigars plunge you into a world of infinite richness, where history, tradition and craftsmanship come together. It is this uniqueness, authenticity and rarity that are the source of their prestige and appeal. Since the 1990s, demand for premium cigars has been growing steadily. The growing interest in collector's cigars represents an opportunity for investors. However, investing in this niche is not something you can improvise. In this article, we give you our top tips for getting started in this fascinating world and making the most of your investments.

Understanding the cigar investment market

As with any investment, the cigar market presents its share of risks. So, before taking the plunge, it's vital to carry out thorough research to understand thespecifics ofthis world. This will enable you to maximize your return on investment,assess the risks andidentify promising opportunities.

Understanding the cigar market means looking at trends, demand, supply and price fluctuations. Unfortunately, there are few comprehensive databases or price trackers for cigars. Nevertheless, you can deepen your knowledge of the market by consulting various reliable sources such as specialist publications and market reports, following auctions and joining discussion forums run by enthusiasts and collectors.

What criteria should I take into account before investing in a cigar?

Knowing how to assess the value of a cigar is essential to determining its potential for appreciation. Before investing in a cigar, it is therefore important to consider several criteria in order to make informed decisions.

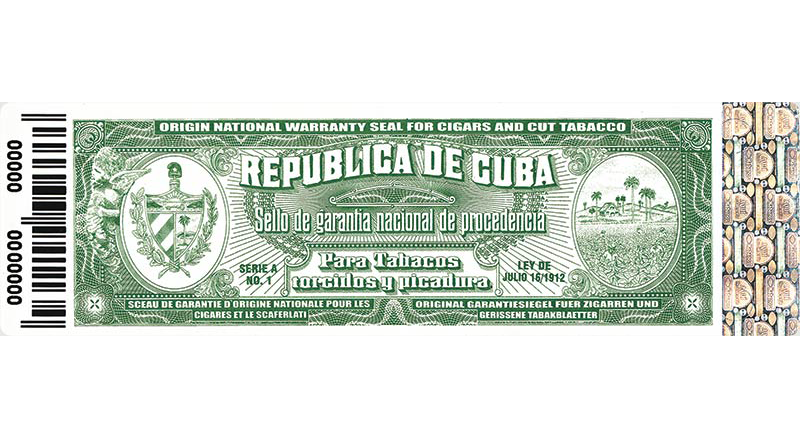

The first thing to consider before buying a cigar is its authenticity. There are many counterfeit cigars on the market, and only cigars of 100% certified origin will give you a return on your investment. So make sure you buy your cigars from a certified retailer who buys exclusively from official importers accredited by the brands. Your cigar box must also bear certain traceability features, such as the Habanos S.A. holographic label and the official importer's guarantee seal (only for Cuban cigars). For Switzerland, the official importer is Intertabak.

The second factor to consider before investing in a cigar is the reputation of its manufacturer. Some brands enjoy a strong reputation for the quality of their manufacturing process and expertise. They have built their reputation on decades of experience and commitment to excellence, making them solid choices for investors concerned with quality and reliability. By choosing cigars from renowned brands such as Cohiba, Trinidad, Arturo Fuente or Davidoff, you're investing in products that are not only appreciated by connoisseurs, but also recognized in the marketplace for their enduring value.

For an investment to be profitable, demand must exceed supply. For this reason, the most lucrative cigars are also the rarest. Most experts agree that Limited Editions, Regional Editions, Reserva and Gran Reserva Editions, special productions and discontinued productions are the best investments. Their demanding manufacturing process and limited production run help to increase their market value. As an example, the 2009 Punch Diademas Limited Edition was released at a retail price of around $221 per box of 10 cigars. In 2018, that same box sold for around $885. Even more impressive, the Cohiba Majestuoso 1966 humidor was put on the market for around $4,000 and today costs just over $45,000. By investing in these exclusive cigars, collectors benefit from significant long-term value enhancement potential.

What precautions should you take to guarantee your investment?

If the authenticity, origin and rarity of your cigars represent the pillars of your investment decisions, these aspects lose their importance if thequality of the cigar does not follow. A cigar with defects or that has been poorly preserved can lose its value, regardless of its presumed prestige.

Although some collectors place a higher value on a sealed cigar box than on an open one, it is essential to ensure the quality of your acquisition if you are to expect a satisfactory return on your investment. We therefore advise you to check the general condition of the cigars before you buy them. Take the time to examine their appearance, the integrity of their wrapper, their firmness and make sure your cigars are free of cracks, damage or mould. Another aspect not to be overlooked is thestate of preservation of your cigars. Like wine, cigars increase in value over time. Once purchased, you need to be able to store them in optimal conditions. So make sure you have a quality humidor with sufficient capacity, and check its settings regularly to maintain ideal temperature and humidity. You can also have them stored and maintained by a professional renowned for his or her expertise, high standards and honesty.

Diversify your portfolio

To maximize your return on investment, it's important to have a diversified portfolio. While Cuban cigars now account for 40% of the world market for premium tobacco*, making habanos a safe investment, other products can enrich your portfolio and guarantee you an attractive return. Dominican and Nicaraguancigars, for example, boast unique flavor profiles that are increasingly appreciated by connoisseurs. As demand for these "New World" cigars continues to grow, investing in recognized premium brands can be a lucrative opportunity.

The profit you can make from your investment also depends on your knowledge of its ageing potential. aging potential and its aromatic profile. For these reasons, it's advisable to invest in cigars you personally enjoy, and to favor complex blends that will age better.

Know when to resell your cigars

Determining the right time to resell your cigars in the booming premium cigar market requires careful analysis. This involves taking into account various elements such as your investment objectives, market trends, macro-economic and political trends, as well as the condition of your cigars.

For example, an economic slowdown or supply outstripping demand may indicate that it's better to wait. Conversely, growing demand and rising prices are favorable signals. It's very difficult to know exactly the right time to enter and exit the market. It takes experience, luck and flair.

In conclusion, investing in cigars can be a profitable venture for those who know how to seize opportunities. You should, however, bear in mind that time is the key to a successful investment. So don't expect to make an immediate profit, and be prepared to wait and hold on to your cigars for a while before reselling them.

*https://www.zonebourse.com/actualite-bourse/Le-premier-fabricant-de-cigares-cubain-voit-ses-ventes-augmenter-grace-aux-acheteurs-europeens-43102394/

FAQ

Why invest in premium cigars?

The global luxury cigar market is expected to reach $25.26 billion by 2030, with a CAGR of 7.80% from 2022 to 2030. The growing appeal of luxury cigars to consumers thus goes hand in hand with market expansion, making cigars a promising investment.

What criteria should I take into account before investing in a cigar?

Before investing in a cigar, check its authenticity and the reputation of its manufacturer. Give preference to limited-edition cigars, which have a higher potential value.

When is the right time to resell cigars?

The right time to resell your cigars depends on your investment objectives, market trends and the condition of your cigars. It's advisable to wait for growing demand and rising prices, while taking into account the general condition of your cigars.